Such as risk components of non-financial items that can be designated in hedging relationships. Designated Hedge Agreement means any Hedge Agreement other than a Commodities Hedge Agreement to which the Borrower or any Subsidiary is a party and as to which at the time such Hedge Agreement is entered into a Lender or any of its Affiliates is a counterparty.

Hedges Of Unrecognized Foreign Currency Denominated Firm Commitments The Cpa Journal

These donations are classified into two categories.

. For financial entities the situation is more complex. A magnet is surrounded by a configured field. 1 the substantial cost of documentation and ongoing monitoring of designated hedges.

An entity is permitted to designate as hedged item an aggregate exposure consisting of a hedged item and a hedging instrument. A fair value hedge is a hedge of the exposure to changes in the fair value of an asset or liability or any such item that is attributable to a particular risk and can result in either profit or loss. Intrinsic value as hedging instrument.

And ongoing monitoring of. Hedge is formed in order to lessen or eliminate economic exposure. An option is introduced to designate credit exposure.

Non- derivative financial instruments measured at FVTPL are eligible. There are two types of hedge recognized. Designated Fair value hedge.

Credit risk hedge accounting is not addressed specifically. Designated Hedges has the meaning given in clause 61. The term however can have different meanings in different states.

A particular type of hedging transaction is having the objective of managing the foreign. For example in California what they refer to as dual agency is called designated agency in many other places. Planned or conceived in detail or for a specific purpose.

As shown in the above example a hedging instrument viz three months copper futures designated in USD terms functional currency being INR is taken for the purpose of hedging the price risk contained in the hedged item of a highly probable forecasted. A vehicle designed for rough terrain. The ongoing development.

Derivatives are initially recognized at fair value on the trade date of the contract and are subsequently re-measured at their fair value. For a fair value hedge the offset is achieved either by marking-to-market an asset or a liability which offsets the PL movement of the. A fair value hedge relates to a fixed value item.

Unrestricted donations can be used for any purpose. Hedge accounting is applied to derivatives entered into in. Organized so as to give configuration to.

Hedging layers of a group. If an entity elects to designate only the intrinsic value of the option as the hedging instrument it must account for the changes in. Hedging instruments qualifying For foreign currency risk non-financial derivative financial instruments may used.

In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges. Carefully practiced or designed or premeditated. When treating the items individually such as a security and its associated hedge fund.

3 a new. The method of recognizing the resulting gain or loss depends on whether the derivative is designated as a hedging instrument and if so the nature of the item being hedged. 2 the availability of natural hedges that can be highly effective.

The two terms can have vastly different meanings. February 2014 Hedge accounting under IFRS 9 1 Contents 1. Detail hedge accounting is described under IAS 39- Financial Instruments.

Accounting for Fair Value Hedges. The Dorothy Bohm v SSCLG 2017 EWHC 3217 Judgment clarifies that just because something is a positive contributor so long as it is. 30 2012 Effective Portion 63 101 236 104 195-27 Losses recognized in other income expense 239 168 231 Hedges Detail Designated Hedge Derivatives Foreign Exchange Contracts Designated Hedge Derivatives Foreign Exchange.

IFRS 9 changed the accounting requirements on using purchased options as hedging instruments. We would like to show you a description here but the site wont allow us. If the company has a designated fair value hedge where the hedged item is taxed in line with its accounting treatment the tax treatment of the derivative is to simply.

Hedge accounting is an accountancy practice the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account. Introduction 2 12 The main changes in the IFRS 9 hedge accounting requirements 3 2 Risk management 4. Accounting for non-designated element of a.

IAS 39 allowed hedging layers of a group in very limited circumstances for example in specified cash flow hedges. It concerned with borrowing in the foreign currency to match the cash flow patterns. It views a purchased option as similar to purchasing insurance cover with the time value being the associated cost.

A layer component can be specified from a defined but open population or from a defined nominal amount. A recent Court Judgment has brought some additional and important clarification on how non-designated heritage assets NDHAs in Conservation Areas should be dealt with in the context of planning decisions. Time value of an option is often the only composite of a premium paid and is considered by risk managers as a cost of hedging IFRS 9BC6387.

Based on 17 documents. IFRS 9 allows a layer of a group to be designated as the hedged item. Designated Hedges means the agreements specified in the Indenture and.

For our purposes we will use dual agency to describe using the same agent for both the buyer and the seller. Restricted donations are either temporary or permanent in nature. Nonprofits receive donations from many different entities.

IFRS 9 allows an alternative of designating full or the intrinsic value of an option as a hedging instrument IFRS 9624 a. Restricted donations can only be used for the designated purpose. 12 Months Ended In Millions unless otherwise specified Jun.

Designated Hedges means any Hedge entered into by the Company that meets the parameters set forth on Schedule A including any Hedge entered into in accordance with the terms set forth in Section 61 b v. The proposed standard simplifies the accounting for hedging activities and generally increases the appeal of hedge accounting. Hedge accounting is an alternative to more traditional accounting methods for recording gains and losses.

Fair value hedge pertains to a fixed value item.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

To Designate Or Not To Designate That Is The Question Bkd

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

Peoplesoft Enterprise Risk Management 9 0 Peoplebook

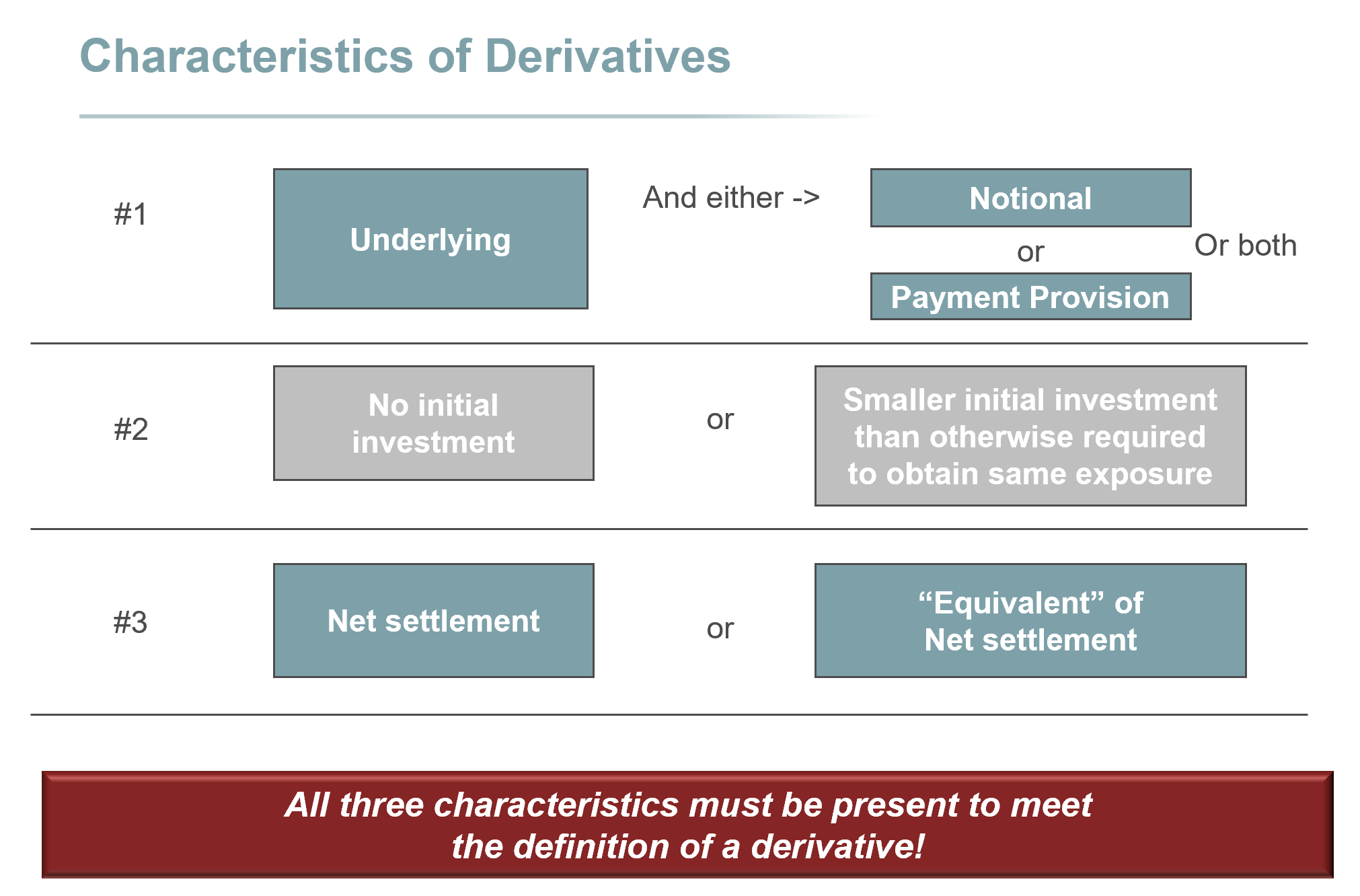

Derivatives And Hedging Gaap Dynamics

0 comments

Post a Comment